Checking for legal insider trading by company's key personnel & institutions is an important step whenever I analyse stocks for options trades based on earnings announcement. I came across a great article about legal insider trading as followed and I hope you would find it useful to guide your next trading decision.

-------------------------------

We want to talk a little about legal insider trading for a minute, because we have seen interesting things happening lately that should be discussed.

When someone mentions insiders making buys or sells, all kinds of flags go up. But it is perfectly legal and ethical for insiders at corporations to sell some of their holdings and buy more when they think the time is right. The real point is "what is the motive?" That is what you (we) all need to try and perceive.

Let's say you are offered a senior management position and in your contract you get 50K shares of company stock after 2 years of service. Nothing out of whack there. Then let's say you are there for 5 years and decide that you want to buy that house up in the mountains. Is there anything wrong with selling 30K shares? Nope, not at all, it was after all part of your pay package.

On the other hand, let's say we see 3 insiders sell most of their holdings in their own company, just a month before earnings season. Does that raise a flag? Yup. When insiders are selling enmasse, it often spells trouble. Think about it. Except for a few well placed sales now and then, there isn't a lot of reason for insiders to be selling unless they don't see any good reason to hold it!

On the other side of the coin, we know of only two reasons that an insider buys his own company's stock. One is that the company puts him up to it. Yes folks, don't be shocked, companies have been known to pressure executives to buy company stock just to give the illusion that the stock is so attractive the insiders are buying it. But, it's generally only a few shares (10K or less) and a few people.

The other reason an insider will buy is that he genuinely believes the stock will appreciate in value. Well, no one has a better view of the company than the people running it right? If insiders are seeing good sales trends and can relate those trends to rising earnings, it makes perfect sense to buy some stock! Now, don't confuse this with stock "buy backs" that we are seeing now and then. A company buy back is a much different animal. It's still a "positive" but not nearly as telling as insiders deciding to buy 100K shares of their own stock.

How can you use this info? Scan the filings folks. If you see two or more insiders buying 40K or more shares of their own stock, we can almost bet you that in the next few months that stock is going to be higher. We saw it happen sometime back with NXTL. We told you that almost 100K shares were purchased by an insider, and "boom" they beat the estimates huge, spiking the stock by 60%. This guy "knew" and it's perfectly legal.

So, when you see insiders buying more than "token" amounts of stock you need to watch that stock. Likewise if you see insiders selling like they are all in a panic to get out, you need to avoid it or maybe even short it. No one knows their own business better than an insider and if they are bailing, you should too. You can also check for insider selling and buying at Yahoo.com, just punch in the stock symbol and then scroll down and look for "insider".

From http://www.optrading.com

----------------------------------------

Some of the web-sites where you check for legal insider trading filing :-

http://www.form4oracle.com

http://www.secform4.com/sec-filings.htm

http://www.sec.gov/edgar/searchedgar/webusers.htm

Wishing you Profitable in your Trading too.

Merry Christmas and a Prosperous 2007 !!!

Yours Sincerely,

Tony Chai

http://www.myoptionsonline.com

Saturday, December 23, 2006

Insider Trading and How To Profit From It

Posted by

Tony Chai

at

7:19 PM

7

comments

![]()

Tuesday, December 12, 2006

New 2007 Edition of the Options Mastery Series

Dear Traders :

The Options University is nearly sold-out of the New "Options Mastery Series 2007 Edition" and are now down to below 100 copies...

Will they release it again? Sure...

But not until March of 2007, and if I have my way, it's going up another 500 bucks to $1997.

Now that may seem like a lot...

But not when you consider what you're getting!

Mr Ron Ianieri has spent 15 YEARS on as a professional options trader to learn these secrets...

...And now you can use the same insider tricks, strategies, and secrets that Ron has used for years to dominate the crowds he was in down on the floor, making millions of dollars for the firms he has worked for... and he made some huge bonuses doing it too.

If you're asking yourself "Then why isn't he still doing it?!?"

Simple.

The floor went digital, and the floor traders were phased out.

Including Ron ...

So he decided this was a chance to do what I've always wanted to do...

Teach options and trade for my myself.

These are 2 of his utmost passions.

And that's good news for you...

Because now you can tap into Mr Ron Ianieri's 15 years of experience and 'look over his shoulder' as he let you in on some of my biggest secrets and teach you about how to consistently pull respectable profit.s out of the markets using options ...

So if you're still "on the fence" we urge you to review the videos and recordings below.

Here's what one student who's been following the Mastery Series since last year had to say about the course:

"I have owned the Options Mastery Series for almost a year now .. and have had a steady winning track record of small trades.

"I started out with a $1,500 account as a result of some poor training by the "Other Guys" and now have an $9,000 account. This I consider not bad for just six months of active trading.

"It took me six months to really become comfortable with the wealth of information Ron was feeding me. It was only after that "I believe I can do this" feeling that I started to make those first small trades (one to three contracts) at first.

"Well, the strategies Ron taught really worked! I believe now that there is no limit to what I can accomplish given I stick to what I have learned. If you truly want to become successful at trading options, then Ron's course is the one you should invest your money and time into."

Jesse Malczyk

Click Here to Read What Our Other Students Are Saying

Posted by

Tony Chai

at

4:10 AM

1 comments

![]()

Labels: Options Mastery Series, Options University, Ron Ianieri

Friday, December 08, 2006

Sharing My Thoughts on Options Trading

It's been almost 2 years since I started trading options - mainly share options. I have to admit 2 years is not long compared to many successful, professional traders who have been trading in no less than 10 years. It's just that I wanted to share some of my personal experiences in this journey so far.

I remembered after graduating from Dr Clemen Chiang's Live Freely Options Trading Seminar back in Nov 2004, I started traded options based on the gapping analysis technique taught in the seminar. My initial trades were good, mostly attributed to the so-called "beginners' luck". Then the trades started turning "bad". I lost money and I began to doubt the technique. The truth is, I haven't master the technique with enough trading experiences. To make matters worst, I "got creative" and developed my own trading techniques and didn't test them first with paper trading and subsequently got punished by the market. No offence to my options trading buddies but I also traded haphazardly based on what were discussed in our online trading forum and they turned out to be losing trades as well.

Watching my capital drained so quickly made me lost quite a bit of confidence thus I shut myself off the market for a few months. In these few months I read some books related to stock & options trading by authors like Lawrence G. McMillan, William J. O'Neil, Nicolas Darvas, Gary Smith etc. I find them useful and gained some knowledge especially on the psychological aspect of trading.

I re-learned what was taught in the Live Freely Options Seminar and reminded myself to follow the steps strictly and only entered an option trade when the conditions were met. I also started a options trading journal - which is actually a MS Word document - where I recorded information like the stock options I chose to trade & had traded, the reasons to enter a trade based on fundamentals research/technical analysis, the outcome of the trade - whether good or bad, the mistakes that I've made and how to avoid them in the future etc. This options trading journal has since become a very important reference tool even till today to guide my options trades.

Once again, the first few trades were good. I've even earned more than 1000% profit from 2 of the trades as recorded here. Then I started growing bored again as a few weeks have passed and I didn't encounter any good options trades based on my gapping analysis conditions. So, I became impatient and went into my "destructive cycle" again trading options based on my "creative techniques" - without testing them with paper trades. This time - I lost money even faster than my 1st round.

So, I became inactive in the options market for a while again and during this time I brushed up my fundamentals analysis research by subscribing to Investors Business Daily SmartSelect Corporate Ratings which provide very thorough analysis of every companies' fundamentals. I learned some more technical analysis stuff like the candlestick chart patterns. At the same time, I also wrote some options trading articles in my web-site which I hope would guide beginner options traders to pick up some basic skills.

I started trading options a few months ago and this time I've been disciplined and trade options based strictly on the conditions which met my gapping analysis research criteria. If no trades satisfy my criteria, I just walk away. I'm glad to inform that so far I've some profitable trades and although I did encounter some losing trades along the way my trading capital is still healthy. I really hope that I will maintain my trading discipline this time round.

Although being disabled, I'm still persevering in this options trading journey even after taking a few hard knocks. I hope this would encourage you not to give up quickly too soon, whether you are now trading options, shares, forex, futures etc.

Here wishing everyone a Merry Christmas and a Healthy & Prosperous 2007.

Yours Truly

Tony Chai

P.S. Are there any options trading secrets? You might ask. From my experiences, winning in the options trading profession comes from the refinement of your trading techniques as you apply and learn from them during your options trading. If a particular options trading technique yields you profits consistently, jot down the circumstances which lead to such winning trades in your trading journal so that when such circumstances occur next time, you would know that entering such trades would yield a higher probability of success. It pays to be patient to stick to a winning formula although the particular technique may not produce that much trading opportunities. Remember that I lost money when I felt bored and experimented with new, untested techniques. So when you feel bored, simply stay away from the options market. Meanwhile, upgrade your trading knowledge by reading books, attending seminars or surfing the internet for relevant information.

Posted by

Tony Chai

at

7:00 PM

13

comments

![]()

Labels: options trading thoughts

Thursday, November 30, 2006

A Losing Trade - CHS

Dear fellow options traders :

Sharing a paper trade on Chico's FAS (CHS) with you :-

Bought a Chico's FAS (CHS) Dec 22.5 Call at about $1.65 on 27 Nov 2006 understanding CHS would report earnings announcement on 28 Nov 2006 after-market-close (AMC).

Back in 2 Nov 2006, CHS provided downward guidance for the 3rd quarter EPS of $0.22-$0.25 and revenue of $402 mln versus the consensus of $0.26 and $420.15 mln respectively. CHS also reported that Oct comps fell 4.1% vs +1.6 consensus. CHS dropped -$2.00 on 2 Nov 2006 to $21.

But CHS climbed back to around $25 by mid Nov. I checked the Form4Oracle site and found that there were some insider buying by the management recently. According to Briefing.com, Barron's reported that the Chief Investment Officer at Hardesty Capital Management began buying shares of CHS back in August and September. That provided me with the confidence to buy a straight call before the earnings announcement.

On 28 Nov 2006 AMC, CHS reported 3rd quarter earnings of $0.24 per share, in line with the Reuters Estimates consensus of $0.24. Revenues rose 12.5% year/year to $404 mln vs the co's $402 mln preannouncement. CHS reported that same-store sales declined 0.4% for the retail month of Nov. CHS did not provide updated guidance for the fourth quarter or for fiscal 2007.

On 29/11/06, CHS stock price did not plunge too drastically. CHS hovered around $23.20 around 9.52am EST. By 10.06am EST, CHS reached $23.26 (+$0.14) and the Dec 22.50 Call could fetch $1.35. CHS reached $23.50 (+$0.38) by 11.04am EST. I sold my Dec 22.50 Call when it could fetch $1.30, suffering a small loss from the price I paid for the call at $1.65.

The above trade was based on gapping analysis, one of the technique taught by Dr Clemen Chiang to trade equity options when I attended the Live Freely Options Trading Seminar Workshop (Singapore).

You can take a look at my review of the Live Freely! Seminar HERE.

If you've managed to find out more about the Live Freely! Seminar from this blog and subsequently sign up for it, I hope you could do me a kind favour and mention Mr Tony Chai from Batch 14 as the referrer. Thank you for your kindness.

Currently, I'm still working hard to achieve profitable trades consistently.

Wishing you Profitable in your Trading too.

Yours Sincerely,

Tony Chai

Posted by

Tony Chai

at

7:30 PM

0

comments

![]()

Labels: CHS

Thursday, November 23, 2006

Winning Trades - GHCI, CWTR

Dear fellow options traders :

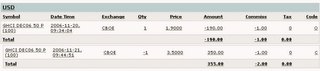

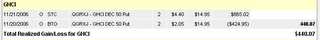

Sharing the following real money & paper trades on GHCI & CWTR with you :-

Referring to the 1st screen capture, I've bought a Genesis Healthcare Corp. (GHCI) Dec 50 Put on 20 Nov 2006 at $1.90. Sold it at $3.50 after earnings announcement on 21 Nov 2006. 4th quarter is a challenging quarter for this heathcare service provider for the elderly. In 2005, GHCI shed almost $6 when reporting the same quarter. I've also checked from the chart that GHCI has reached its 52-week high of $50 recently and felt that if there's any weakness in the 4th quarter earnings, the share might retreat from this new high.

On 21 Nov 2006, Genesis Healthcare Corp. reported that its 4th quarter profit fell by 39%, dragged down by a $5.5 million writedown for two centers. However, excluding the charges, 4th quarter EPS was $0.62, $0.01 higher than Reuters Estimates consensus of $0.61. Revenues rose 6.2% year/year to $453.6 mln vs the $451.2 mln consensus.

Genesis said it expects 2007 profit between $2.43 and $2.48 per share, versus the average analyst forecast of $2.59 per share.

The above trades on GHCI & Coldwater Creek Inc. (CWTR) were based on gapping analysis, one of the technique taught by Dr Clemen Chiang to trade equity options when I attended the Live Freely Options Trading Seminar Workshop (Singapore).

You can take a look at my review of the Live Freely! Seminar HERE.

If you've managed to find out more about the Live Freely! Seminar from this blog and subsequently sign up for it, I hope you could do me a kind favour and mention Mr Tony Chai from Batch 14 as the referrer. Thank you for your kindness.

Currently, I'm still working hard to achieve profitable trades consistently.

Wishing you Profitable in your Trading too.

Yours Sincerely,

Tony Chai

Posted by

Tony Chai

at

7:57 AM

1 comments

![]()

Labels: CWTR

Monday, November 20, 2006

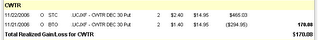

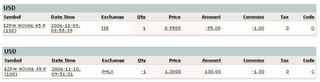

Winning Trades - EZPW, GYMB, JBL, OMG

Dear fellow options traders :

Some options trades to share with you :-

The above trades were based on gapping analysis, was one of the technique taught by Dr Clemen Chiang to trade equity options when I attended the Live Freely Options Trading Seminar Workshop (Singapore).

You can take a look at my review of the Live Freely! Seminar HERE.

If you've managed to find out more about the Live Freely! Seminar from this blog and subsequently sign up for it, I hope you could do me a kind favour and mention Mr Tony Chai from Batch 14 as the referrer. Thank you for your kindness.

Currently, I'm still working hard to achieve profitable trades consistently.

Wishing you Profitable in your Trading too.

Yours Sincerely,

Tony Chai

Posted by

Tony Chai

at

8:22 AM

2

comments

![]()

Sunday, November 12, 2006

** Important NASDAQ video announcement **

WATCH THE VIDEO

Major developments in the U.S. stock options market are about to be announced.

Go ahead and watch this 8-minute trading video for an update of this critical information :

This video is going to do one of two things..

It'll either get you pumped up and excited like never before, or upset

anxious, and agitated that "change" is about to take place and run

rampant throughout the stock market... But I think you'll be excited.

Either way, it will affect YOU and your trading dramatically.

What happened was ...

I received an important email a few days ago from renowned options trader, Mr Ron Ianieri & Mr Brett Fogle of The Options University.

It opened with the following statement...

"Major News in the stock market has just come out, and traders everywhere are 'buzzing' about the recent NASDAQ announcements that will affect the way people trade forever. (What it all means to the stock market and your trading (HINT: you may never trade stock again...)"

It captured my attention.

All I can say is watch the video this very minute.

WATCH THE VIDEO

Here's why...

Mr Ron Ianieri, a former 10-year floor trader and lead options market-maker, revealed a recent Nasdaq announcement that was just released that would rock the trading community the likes of which not seen in 100 years...

Plus he drops two other important announcements...

The information in the video are MAJOR developments in the trading markets. They were just announced to the public for the first time ever -- and will certainly impact your ability to extract profits from the markets going forward like never before (and in more ways than you think).

Since Mr Ron Ianieri is so excited about these new developments, he's putting

together a series of free training sessions and educational materials that he's personally putting together for you to bring you up to speed.

Nothing to buy. Just quality information.

He feels it's his professional duty to arm you with this critical information,

in light of these recent announcements. (You will agree when you find out).

View the video now to see exactly it's all about and why it would be at your disadvantage if you don't at least try getting all the facts... whether or not you ever trade options.

The markets are about to change forever... and even if you have no interest

in trading options -- you can't afford *NOT* to know about these developments.

Here's where you can get all the details and watch the video now:

WATCH THE VIDEO

(NOTE: This video will be pulled down within the next week, without notice.

Mr Ron Ianieri and Mr Brett Fogle don't want this information floating all around the internet, so be sure to go there and watch the video now.)

Best regards,

Tony Chai

P.S. Fortunes will be made in the next 12-18 months with this new information.

P.P.S. Mr Ron Ianieri only speaks out like this when there's something of vital importance to tell you. This is too important to miss. Visit link below to view the video now before it's pulled down forever. (Don't say I didn't warn you)

WATCH THE VIDEO

Posted by

Tony Chai

at

12:15 AM

3

comments

![]()

Labels: Options Mastery Series, Options trading course, Options University, Ron Ianieri

Saturday, November 11, 2006

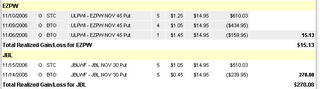

Winning Trade - EZPW

Ezcorp Inc (EZPW) operated payday lending & pawnshops in the USA. It has already raised guidance for its 4th quarter, FY06 & FY07 EPS on 12 Oct 2006 and EZPW traded up $6 on 13 Oct 2006. On the last few days leading to its earnings announcement on 9 Nov 2006, EZPW has even surpassed its resistance price level of $46.00 and ended about $48.50 on 9 Nov 2006.

To avoid the wrath of consumer-interest groups & regulators in certain states who dislike payday lenders, EZ Corp. has cleverly located its 330 EZMONEY payday lender shops in the 13 states, primarily in the South, where such problems could be avoided. Moreover, I’ve found that their cash position ended 30 June 2006 was much stronger compared to that in their financial year ended 30 Sep 2005.

I've bought a Nov 45 Put for $95 on 9 Nov 2006 more out of a contrarian trade. I noticed that there were some legal insider trading reported in the Form 4 Oracle web-siteon the few days after their upside guidance announcement and that made me cautious about buying a call, especially that EZPW had moved quite a few points above the resistance priceline (ie. $46) from 6 to 9 Nov 2006. At one point after the earnings announcement in after-market-trading, EZPW even touched $50.00.

EZPW announced earnings on 9 Nov 2006 after-market-close of 4th Quarter EPS of $0.60 per share, $0.02 worse than the Reuters Estimates consensus of $0.62. But it beat revenue at $87.4 mln vs the $86.1 mln consensus. EZPW issued in-line guidance for Q1 & reaffirmed guidance for FY07.

On 10/11/06, EZPW dropped -$4.80 to $43.55 around 10.02 am EST. By 10.03am EST, EZPW dropped -$5.30 to $43.00. Nov 45 Put could fetch $2.45. Around 10.06am EST, buyer side of the Level II code started turning stronger. Around 10.15am EST, EZPW stabilized at -$3.94 to $44.41. The Nov 45 Put could fetch $1.60. Level II buyer side kept getting stronger. By 11.00am EST, EZPW dropped -$3.32 to $45.03. The Nov 45 Put fetched $1.30, the price I sold around 9.45am EST.

The above (gapping analysis) was one of the technique taught by Dr Clemen Chiang to trade equity options when I attended the Live Freely Options Trading Seminar Workshop (Singapore).

You can take a look at my review of the Live Freely! Seminar HERE.

If you've managed to find out more about the Live Freely! Seminar from this blog and subsequently sign up for it, I hope you could do me a kind favour and mention Mr Tony Chai from Batch 14 as the referrer. Thank you for your kindness.

Currently, I'm still working hard to achieve profitable trades consistently.

Wishing you Profitable in your Trading too.

Yours Sincerely,

Tony Chai

Posted by

Tony Chai

at

10:48 PM

0

comments

![]()

Labels: EZPW

Thursday, November 02, 2006

Winning Trade on CKFR

spacer

Dear Options Traders :

Paper traded 5 contracts of CKFR Nov 45 Put bought at $3.40 on 24 Oct 2006 and after earnings announcement sold them at prices of $7.80, $7.90 and $8.00 respectively.

Reason for buying Put : Understood that if the transaction volume did not improve this quarter (the decline in transaction volume last quarter resulted in the share falling -$7.00 on 2 Aug 2006 after earnings announcement) the share might follow suite this time.

On 24/10/06 (Tuesday) after-market-close, CKFR reported earnings of beating EPS by $0.02 for quarter Q1 ended Sep 2006 but guided Q2 EPS & Revenue below consensus. CKFR gapped down $5.49 after the announcement. On 25/10/06, CKFR dropped $6.34 to $37.21 by 9.38am EST.

The above (gapping analysis) was one of the technique taught by Dr Clemen Chiang to trade equity options when I attended the Live Freely Options Trading Seminar Workshop (Singapore).

You can take a look at my review of the Live Freely! Seminar HERE.

If you've managed to find out about the Live Freely! Seminar from my stock options trading blog and subsequently sign up for it, I hope you could do me a kind favour and mention Mr Tony Chai from Batch 14 as the referrer. Thank you for your kindness.

Currently, I'm still working hard to achieve profitable trades consistently.

Wishing you Profitable in your Trading too.

Yours Sincerely,

Tony Chai

Posted by

Tony Chai

at

8:07 PM

0

comments

![]()

Labels: CKFR

Winning Trade on NFLX

spacer

Greetings everyone,

Paper traded by buying 5 contracts of NFLX Nov 22.5 Call on 23 Oct 2006 at $1.95. After earnings announcement, I sold the call options at prices of $4.90 and $5.30 respectively on 24 Oct 2006.

Reasons for buying a call contract - I researched that during the last earnings announcement on 24 July 2006, NFLX gapped down although net income from the Income Statement, cash position in balance sheet and cash flow were outstanding for 2nd quarter end June 2006 were good.

Fool.com has a report about confidence in the CEO. Also, Briefing.com runs a review of analysts expectation for this quarter earnings and most were positive.

Thus with all the above factors I bought a call.

The above (gapping analysis) was one of the technique taught by Dr Clemen Chiang to trade equity options when I attended the Live Freely Options Trading Seminar Workshop (Singapore).

You can take a look at my review of the Live Freely! Seminar HERE.

If you've managed to find out more about the Live Freely! Seminar from this blog and subsequently sign up for it, I hope you could do me a kind favour and mention Mr Tony Chai from Batch 14 as the referrer. Thank you for your kindness.

Currently, I'm still working hard to achieve profitable trades consistently.

Wishing you Profitable in your Trading too.

Yours Sincerely,

Tony Chai

Posted by

Tony Chai

at

3:24 AM

0

comments

![]()

Labels: NFLX

Tuesday, October 17, 2006

Dow Touching 12,000 Level

spacer

The Dow Jones Industrial Average ($INDU) almost touched the 12,000 points on 16 Oct 2006.

On 16 Oct 2006, the Dow closed up 20.09 points, or 0.17%, to reach 11,980.60. In the final hour of trading, the index reached a record trading high of 11,997.25.

However, on 17 Oct 2006, the Dow ended down 31 points to 11,950. The setback was partly due to the bigger-than-expected 0.6% jump in Sep 2006 in the core inflation, which excludes energy and food. Investors were concerned this might prompt the Federal Reserve to raise interest rates next week.

Moreover, the Federal Reserve reported that that industrial output dropped by 0.6% in Sep 2006, a much bigger decline than the 0.1% drop that Wall Street had anticipated. Slowing production in the nation's factory was in reaction to the overall economic slowdown.

In another development, Yahoo! (YHOO) reported earnings results for the 3rd Quarter (Sep 2006) on 17 Oct 2006 after-market-close. EPS was $0.11 per share, in-line with Reuters Estimates consensus of $0.11; revenues rose 20.3% yr/yr to $1.12 bln vs the $1.14 bln consensus. The Co. issued downside guidance for Q4, sees Q4 revenue of $1.15-1.27 bln vs. $1.3 bln consensus.

YHOO share price did not plunge after the earnings announcement. YHOO had earlier shed more than $3.00 on 19 Sep 2006 when it said it saw slowing/weakness growth in Auto's and Financial services advertising which might impact the 3rd quarter earnings at bottom half of range.

Posted by

Tony Chai

at

8:51 PM

0

comments

![]()

Thursday, August 24, 2006

A Winning Trade on PDCO

spacer

Paper traded a put option on Patterson Companies Inc. (PDCO) on 23 Aug 2006, eve of earnings announcement. On 24 Aug 2006, PDCO dropped $1.30 to $31.50 around 9.45am EST. At 10.05am EST, PDCO reached $31.50 (-$1.30). Sold my put option for a profit of about $500.

The drop was because PDCO Patterson Companies missed their 1st Quarter EPS by $0.02 though their revenue rose 10.0% y/y to $655.5 mln vs. consensus of $654.1 mln. PDCO also issued downside guidance for FY07, sees EPS of $1.54-1.57 vs. $1.58 consensus.

The above was one of the technique taught by Dr Clemen Chiang to trade equity options when I attended the Live Freely Options Trading Seminar Workshop (Singapore). I graduated from Batch 14.

I'm still working hard to maintain consistency in achieving profitable trades.

Wishing you Profitable in your Trading too.

Yours Sincerely ,

Tony Chai

Posted by

Tony Chai

at

3:51 PM

3

comments

![]()

Labels: PDCO

Saturday, August 19, 2006

Impressive Week

spacer

The market ended the week impressively.

The NASDAQ Composite Index (ticker : $COMPQ) surged 106.24 points, or 5.16%, to end at 2,163.95.

The S&P 500 index ($SPX) added 35.56 points, or 2.81%, to close the week at 1,302.30.

Meanwhile, the Dow Jones Industrial Average ($INDU) ended the week up 293.44 points, or 2.65%, finishing at 11,381.47.

This despite that the preliminary consumer sentiment index fell to 78.7 in Aug 2006 released by the University of Michigan on 18 Aug 2006. Wall Street had expected the index to slide to 83.8. The greater-than-expected drop was viewed as a signal that the economy might weaken too much.

Options traders should monitor the market sentiment closely next week to see whether the rally would carry on.

Posted by

Tony Chai

at

4:22 AM

0

comments

![]()

Thursday, August 17, 2006

Market Sentiment

spacer

For the past 2 days stock market rose.

On Tuesday, the Producer Price Index (PPI) showed that prices at the wholesale level only edged up 0.1% in July 2006, well below the 0.5% jump in June.

On Wednesday, The Labour Department announced that the Consumer Price Index (CPI) rose by 0.4% in July 2006. But the industrial output in July 2006 slipped to just 4%, half the June pace, an indication that the economy is slowing.

With the data showing a decline in inflation pressures and slowing of economy (also because of the cooling housing market), investors felt that the Federal Reserve might pause further interest rates hike, which would otherwise threaten economic growth and hinder corporate profits.

The Dow Jones Industrial Average was pushed to its highest level in three months on Wednesday.

Investors who bought Abercrombie & Fitch Co. (ANF) calls would be delighted as the share gapped up $5 after earnings announcement and rose another $2 intra-day. ANF's revenue rose 15.2% yr/yr. The company also issued upside guidance for FY07. ANF average trading volume is about 2.2M shares.

Posted by

Tony Chai

at

8:37 AM

0

comments

![]()

Labels: ANF

Tuesday, August 15, 2006

DE - earnings

DE (Deere & Co.) announced earnings on 15 Aug 2006 before market opens. Revenue increased 5.7% to $5.68 bln year/year. Reported 3rd quarter EPS of $1.85 per share, $0.04 better than the Reuters consensus of $1.81.

When market opened on 15 Aug 2006, DE gapped down about $1 to $67.50 but went up quickly to close the gap. DE then went down to about $67 about 9.52am EST, but shot up to $69 at 10.16am EST. The stock went up to $69.83 by 10.35am EST.

If you bought a put option before earnings announcement, you might recover some of the premium if you sell between 9.40am EST and 9.50am EST. The stock has already dropped from $82 to $70 since mid July 2006. Thus, take note that buying a put for this earnings play might not see further downside.

Posted by

Tony Chai

at

3:56 PM

0

comments

![]()

Labels: DE

Sunday, August 13, 2006

How will DE do?

With the economy slowing & inflation on the rise, it seemed to be a ripe time for put buyers. However, stocks like Priceline.com (PCLN) & Cisco System (CSCO) rallied after their earnings announcement last week. Thus, put buyers should still be prudent in their choice of options trades despite this "weak" market.

I've been looking for news of any reported cases of drought which might effect Deere & Co. (DE) agricultural equipment's business but have not found any. This share has gone down from $82 to $70 since mid July 2006. How would this stock perform after its earnings announcement on 15 June 2006? We'll see.

Posted by

Tony Chai

at

3:55 PM

0

comments

![]()

Thursday, March 23, 2006

KBH Trade - 23/3/06

>

Entered a limit order to buy a KBH Apr 60 Put at $0.95 but was not filled.

On 22/3/06 AMC (after market close), KBH reported earnings for the 1st quarter of $2.02 per share, $0.06 better than the Reuters Estimates consensus of $1.96. Revenue rose 34% compared to 2005 to $2.19 bln vs the $2.24 bln consensus.

On 23/3/06, share gapped up about $0.90 when market opened but when better than expected exisiting home sales figures were announced, it prompted share to go up further and close at the end of the day at $67.82 (+3.23).

GOOG was added to the S & P 500 AMC and shot up $31 to reach $373.50 in after market trading.

Posted by

Tony Chai

at

6:11 PM

3

comments

![]()

Wednesday, March 22, 2006

KBH Trade - 22/3/06

On 21/3/06 AMC (after market close), NKE reported 3rd quarter earnings of $1.24 per share, 14cts better than the Reuters Estimates consensus of $1.10. Revenues rose 9.0% year/year to $3.61 Billion vs the $3.53 Billion consensus.

On 22/3/06, NKE gapped down $0.20 when market opened. I Sold my NKE Apr 85 Call for $1.85 at a loss of $0.55. I bought the call option at $2.40 on 21/3/06. I sold too fast because NKE rebounded to $85.75 around 10.07am EST and the call could fetch $2.30. Would remember this next time, though I felt the option was a little expensive to buy in the first place anyway (I consider an option with time value > $2 expensive, remember, it's time value, not intrinsic value)

Tonight, KB Home (KBH) would be reporting earnings AMC. Would try buying a Apr 60 Put at a limit order of $0.95 in the understanding that the housing sector might be entering a cyclical slowdown.

Posted by

Tony Chai

at

8:36 AM

1 comments

![]()

Tuesday, March 21, 2006

NKE trade - 21/3/06

Going to paper trade NIKE, Inc. (NKE) option tonight. NKE would report earnings today after market close (AMC).

NKE is market leader in the apparel & footware industry in terms of market capitalization. Daily trading volume is 1.88M. Would only enter option position some time before market close today.

Noted that DJ US Personal Goods Index broke resistance after mid March 2006. On 28/2/06, Thomas Weisel commented based on channel checks NKE appeared well positioned ahead of the spring season. Currently at 10am EST NKE is at $85.35. April 85 Call is at $2.80 (ie. time value @ $2.50). Implied Volatility is at 24.5, hist. volatility is 11.61.

Would enter option trade near market closing hour.

Posted by

Tony Chai

at

6:57 AM

0

comments

![]()

Labels: NKE