Dear fellow options traders :

Sharing a paper trade on Chico's FAS (CHS) with you :-

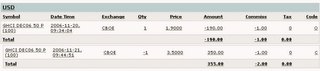

Bought a Chico's FAS (CHS) Dec 22.5 Call at about $1.65 on 27 Nov 2006 understanding CHS would report earnings announcement on 28 Nov 2006 after-market-close (AMC).

Back in 2 Nov 2006, CHS provided downward guidance for the 3rd quarter EPS of $0.22-$0.25 and revenue of $402 mln versus the consensus of $0.26 and $420.15 mln respectively. CHS also reported that Oct comps fell 4.1% vs +1.6 consensus. CHS dropped -$2.00 on 2 Nov 2006 to $21.

But CHS climbed back to around $25 by mid Nov. I checked the Form4Oracle site and found that there were some insider buying by the management recently. According to Briefing.com, Barron's reported that the Chief Investment Officer at Hardesty Capital Management began buying shares of CHS back in August and September. That provided me with the confidence to buy a straight call before the earnings announcement.

On 28 Nov 2006 AMC, CHS reported 3rd quarter earnings of $0.24 per share, in line with the Reuters Estimates consensus of $0.24. Revenues rose 12.5% year/year to $404 mln vs the co's $402 mln preannouncement. CHS reported that same-store sales declined 0.4% for the retail month of Nov. CHS did not provide updated guidance for the fourth quarter or for fiscal 2007.

On 29/11/06, CHS stock price did not plunge too drastically. CHS hovered around $23.20 around 9.52am EST. By 10.06am EST, CHS reached $23.26 (+$0.14) and the Dec 22.50 Call could fetch $1.35. CHS reached $23.50 (+$0.38) by 11.04am EST. I sold my Dec 22.50 Call when it could fetch $1.30, suffering a small loss from the price I paid for the call at $1.65.

The above trade was based on gapping analysis, one of the technique taught by Dr Clemen Chiang to trade equity options when I attended the Live Freely Options Trading Seminar Workshop (Singapore).

You can take a look at my review of the Live Freely! Seminar HERE.

If you've managed to find out more about the Live Freely! Seminar from this blog and subsequently sign up for it, I hope you could do me a kind favour and mention Mr Tony Chai from Batch 14 as the referrer. Thank you for your kindness.

Currently, I'm still working hard to achieve profitable trades consistently.

Wishing you Profitable in your Trading too.

Yours Sincerely,

Tony Chai

Thursday, November 30, 2006

A Losing Trade - CHS

Posted by

Tony Chai

at

7:30 PM

0

comments

![]()

Labels: CHS

Thursday, November 23, 2006

Winning Trades - GHCI, CWTR

Dear fellow options traders :

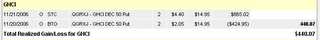

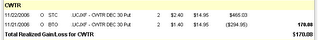

Sharing the following real money & paper trades on GHCI & CWTR with you :-

Referring to the 1st screen capture, I've bought a Genesis Healthcare Corp. (GHCI) Dec 50 Put on 20 Nov 2006 at $1.90. Sold it at $3.50 after earnings announcement on 21 Nov 2006. 4th quarter is a challenging quarter for this heathcare service provider for the elderly. In 2005, GHCI shed almost $6 when reporting the same quarter. I've also checked from the chart that GHCI has reached its 52-week high of $50 recently and felt that if there's any weakness in the 4th quarter earnings, the share might retreat from this new high.

On 21 Nov 2006, Genesis Healthcare Corp. reported that its 4th quarter profit fell by 39%, dragged down by a $5.5 million writedown for two centers. However, excluding the charges, 4th quarter EPS was $0.62, $0.01 higher than Reuters Estimates consensus of $0.61. Revenues rose 6.2% year/year to $453.6 mln vs the $451.2 mln consensus.

Genesis said it expects 2007 profit between $2.43 and $2.48 per share, versus the average analyst forecast of $2.59 per share.

The above trades on GHCI & Coldwater Creek Inc. (CWTR) were based on gapping analysis, one of the technique taught by Dr Clemen Chiang to trade equity options when I attended the Live Freely Options Trading Seminar Workshop (Singapore).

You can take a look at my review of the Live Freely! Seminar HERE.

If you've managed to find out more about the Live Freely! Seminar from this blog and subsequently sign up for it, I hope you could do me a kind favour and mention Mr Tony Chai from Batch 14 as the referrer. Thank you for your kindness.

Currently, I'm still working hard to achieve profitable trades consistently.

Wishing you Profitable in your Trading too.

Yours Sincerely,

Tony Chai

Posted by

Tony Chai

at

7:57 AM

1 comments

![]()

Labels: CWTR

Monday, November 20, 2006

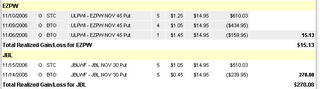

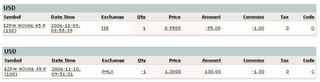

Winning Trades - EZPW, GYMB, JBL, OMG

Dear fellow options traders :

Some options trades to share with you :-

The above trades were based on gapping analysis, was one of the technique taught by Dr Clemen Chiang to trade equity options when I attended the Live Freely Options Trading Seminar Workshop (Singapore).

You can take a look at my review of the Live Freely! Seminar HERE.

If you've managed to find out more about the Live Freely! Seminar from this blog and subsequently sign up for it, I hope you could do me a kind favour and mention Mr Tony Chai from Batch 14 as the referrer. Thank you for your kindness.

Currently, I'm still working hard to achieve profitable trades consistently.

Wishing you Profitable in your Trading too.

Yours Sincerely,

Tony Chai

Posted by

Tony Chai

at

8:22 AM

2

comments

![]()

Sunday, November 12, 2006

** Important NASDAQ video announcement **

WATCH THE VIDEO

Major developments in the U.S. stock options market are about to be announced.

Go ahead and watch this 8-minute trading video for an update of this critical information :

This video is going to do one of two things..

It'll either get you pumped up and excited like never before, or upset

anxious, and agitated that "change" is about to take place and run

rampant throughout the stock market... But I think you'll be excited.

Either way, it will affect YOU and your trading dramatically.

What happened was ...

I received an important email a few days ago from renowned options trader, Mr Ron Ianieri & Mr Brett Fogle of The Options University.

It opened with the following statement...

"Major News in the stock market has just come out, and traders everywhere are 'buzzing' about the recent NASDAQ announcements that will affect the way people trade forever. (What it all means to the stock market and your trading (HINT: you may never trade stock again...)"

It captured my attention.

All I can say is watch the video this very minute.

WATCH THE VIDEO

Here's why...

Mr Ron Ianieri, a former 10-year floor trader and lead options market-maker, revealed a recent Nasdaq announcement that was just released that would rock the trading community the likes of which not seen in 100 years...

Plus he drops two other important announcements...

The information in the video are MAJOR developments in the trading markets. They were just announced to the public for the first time ever -- and will certainly impact your ability to extract profits from the markets going forward like never before (and in more ways than you think).

Since Mr Ron Ianieri is so excited about these new developments, he's putting

together a series of free training sessions and educational materials that he's personally putting together for you to bring you up to speed.

Nothing to buy. Just quality information.

He feels it's his professional duty to arm you with this critical information,

in light of these recent announcements. (You will agree when you find out).

View the video now to see exactly it's all about and why it would be at your disadvantage if you don't at least try getting all the facts... whether or not you ever trade options.

The markets are about to change forever... and even if you have no interest

in trading options -- you can't afford *NOT* to know about these developments.

Here's where you can get all the details and watch the video now:

WATCH THE VIDEO

(NOTE: This video will be pulled down within the next week, without notice.

Mr Ron Ianieri and Mr Brett Fogle don't want this information floating all around the internet, so be sure to go there and watch the video now.)

Best regards,

Tony Chai

P.S. Fortunes will be made in the next 12-18 months with this new information.

P.P.S. Mr Ron Ianieri only speaks out like this when there's something of vital importance to tell you. This is too important to miss. Visit link below to view the video now before it's pulled down forever. (Don't say I didn't warn you)

WATCH THE VIDEO

Posted by

Tony Chai

at

12:15 AM

3

comments

![]()

Labels: Options Mastery Series, Options trading course, Options University, Ron Ianieri

Saturday, November 11, 2006

Winning Trade - EZPW

Ezcorp Inc (EZPW) operated payday lending & pawnshops in the USA. It has already raised guidance for its 4th quarter, FY06 & FY07 EPS on 12 Oct 2006 and EZPW traded up $6 on 13 Oct 2006. On the last few days leading to its earnings announcement on 9 Nov 2006, EZPW has even surpassed its resistance price level of $46.00 and ended about $48.50 on 9 Nov 2006.

To avoid the wrath of consumer-interest groups & regulators in certain states who dislike payday lenders, EZ Corp. has cleverly located its 330 EZMONEY payday lender shops in the 13 states, primarily in the South, where such problems could be avoided. Moreover, I’ve found that their cash position ended 30 June 2006 was much stronger compared to that in their financial year ended 30 Sep 2005.

I've bought a Nov 45 Put for $95 on 9 Nov 2006 more out of a contrarian trade. I noticed that there were some legal insider trading reported in the Form 4 Oracle web-siteon the few days after their upside guidance announcement and that made me cautious about buying a call, especially that EZPW had moved quite a few points above the resistance priceline (ie. $46) from 6 to 9 Nov 2006. At one point after the earnings announcement in after-market-trading, EZPW even touched $50.00.

EZPW announced earnings on 9 Nov 2006 after-market-close of 4th Quarter EPS of $0.60 per share, $0.02 worse than the Reuters Estimates consensus of $0.62. But it beat revenue at $87.4 mln vs the $86.1 mln consensus. EZPW issued in-line guidance for Q1 & reaffirmed guidance for FY07.

On 10/11/06, EZPW dropped -$4.80 to $43.55 around 10.02 am EST. By 10.03am EST, EZPW dropped -$5.30 to $43.00. Nov 45 Put could fetch $2.45. Around 10.06am EST, buyer side of the Level II code started turning stronger. Around 10.15am EST, EZPW stabilized at -$3.94 to $44.41. The Nov 45 Put could fetch $1.60. Level II buyer side kept getting stronger. By 11.00am EST, EZPW dropped -$3.32 to $45.03. The Nov 45 Put fetched $1.30, the price I sold around 9.45am EST.

The above (gapping analysis) was one of the technique taught by Dr Clemen Chiang to trade equity options when I attended the Live Freely Options Trading Seminar Workshop (Singapore).

You can take a look at my review of the Live Freely! Seminar HERE.

If you've managed to find out more about the Live Freely! Seminar from this blog and subsequently sign up for it, I hope you could do me a kind favour and mention Mr Tony Chai from Batch 14 as the referrer. Thank you for your kindness.

Currently, I'm still working hard to achieve profitable trades consistently.

Wishing you Profitable in your Trading too.

Yours Sincerely,

Tony Chai

Posted by

Tony Chai

at

10:48 PM

0

comments

![]()

Labels: EZPW

Thursday, November 02, 2006

Winning Trade on CKFR

spacer

Dear Options Traders :

Paper traded 5 contracts of CKFR Nov 45 Put bought at $3.40 on 24 Oct 2006 and after earnings announcement sold them at prices of $7.80, $7.90 and $8.00 respectively.

Reason for buying Put : Understood that if the transaction volume did not improve this quarter (the decline in transaction volume last quarter resulted in the share falling -$7.00 on 2 Aug 2006 after earnings announcement) the share might follow suite this time.

On 24/10/06 (Tuesday) after-market-close, CKFR reported earnings of beating EPS by $0.02 for quarter Q1 ended Sep 2006 but guided Q2 EPS & Revenue below consensus. CKFR gapped down $5.49 after the announcement. On 25/10/06, CKFR dropped $6.34 to $37.21 by 9.38am EST.

The above (gapping analysis) was one of the technique taught by Dr Clemen Chiang to trade equity options when I attended the Live Freely Options Trading Seminar Workshop (Singapore).

You can take a look at my review of the Live Freely! Seminar HERE.

If you've managed to find out about the Live Freely! Seminar from my stock options trading blog and subsequently sign up for it, I hope you could do me a kind favour and mention Mr Tony Chai from Batch 14 as the referrer. Thank you for your kindness.

Currently, I'm still working hard to achieve profitable trades consistently.

Wishing you Profitable in your Trading too.

Yours Sincerely,

Tony Chai

Posted by

Tony Chai

at

8:07 PM

0

comments

![]()

Labels: CKFR

Winning Trade on NFLX

spacer

Greetings everyone,

Paper traded by buying 5 contracts of NFLX Nov 22.5 Call on 23 Oct 2006 at $1.95. After earnings announcement, I sold the call options at prices of $4.90 and $5.30 respectively on 24 Oct 2006.

Reasons for buying a call contract - I researched that during the last earnings announcement on 24 July 2006, NFLX gapped down although net income from the Income Statement, cash position in balance sheet and cash flow were outstanding for 2nd quarter end June 2006 were good.

Fool.com has a report about confidence in the CEO. Also, Briefing.com runs a review of analysts expectation for this quarter earnings and most were positive.

Thus with all the above factors I bought a call.

The above (gapping analysis) was one of the technique taught by Dr Clemen Chiang to trade equity options when I attended the Live Freely Options Trading Seminar Workshop (Singapore).

You can take a look at my review of the Live Freely! Seminar HERE.

If you've managed to find out more about the Live Freely! Seminar from this blog and subsequently sign up for it, I hope you could do me a kind favour and mention Mr Tony Chai from Batch 14 as the referrer. Thank you for your kindness.

Currently, I'm still working hard to achieve profitable trades consistently.

Wishing you Profitable in your Trading too.

Yours Sincerely,

Tony Chai

Posted by

Tony Chai

at

3:24 AM

0

comments

![]()

Labels: NFLX