Ezcorp Inc (EZPW) operated payday lending & pawnshops in the USA. It has already raised guidance for its 4th quarter, FY06 & FY07 EPS on 12 Oct 2006 and EZPW traded up $6 on 13 Oct 2006. On the last few days leading to its earnings announcement on 9 Nov 2006, EZPW has even surpassed its resistance price level of $46.00 and ended about $48.50 on 9 Nov 2006.

To avoid the wrath of consumer-interest groups & regulators in certain states who dislike payday lenders, EZ Corp. has cleverly located its 330 EZMONEY payday lender shops in the 13 states, primarily in the South, where such problems could be avoided. Moreover, I’ve found that their cash position ended 30 June 2006 was much stronger compared to that in their financial year ended 30 Sep 2005.

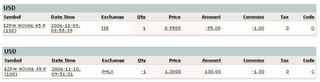

I've bought a Nov 45 Put for $95 on 9 Nov 2006 more out of a contrarian trade. I noticed that there were some legal insider trading reported in the Form 4 Oracle web-siteon the few days after their upside guidance announcement and that made me cautious about buying a call, especially that EZPW had moved quite a few points above the resistance priceline (ie. $46) from 6 to 9 Nov 2006. At one point after the earnings announcement in after-market-trading, EZPW even touched $50.00.

EZPW announced earnings on 9 Nov 2006 after-market-close of 4th Quarter EPS of $0.60 per share, $0.02 worse than the Reuters Estimates consensus of $0.62. But it beat revenue at $87.4 mln vs the $86.1 mln consensus. EZPW issued in-line guidance for Q1 & reaffirmed guidance for FY07.

On 10/11/06, EZPW dropped -$4.80 to $43.55 around 10.02 am EST. By 10.03am EST, EZPW dropped -$5.30 to $43.00. Nov 45 Put could fetch $2.45. Around 10.06am EST, buyer side of the Level II code started turning stronger. Around 10.15am EST, EZPW stabilized at -$3.94 to $44.41. The Nov 45 Put could fetch $1.60. Level II buyer side kept getting stronger. By 11.00am EST, EZPW dropped -$3.32 to $45.03. The Nov 45 Put fetched $1.30, the price I sold around 9.45am EST.

The above (gapping analysis) was one of the technique taught by Dr Clemen Chiang to trade equity options when I attended the Live Freely Options Trading Seminar Workshop (Singapore).

You can take a look at my review of the Live Freely! Seminar HERE.

If you've managed to find out more about the Live Freely! Seminar from this blog and subsequently sign up for it, I hope you could do me a kind favour and mention Mr Tony Chai from Batch 14 as the referrer. Thank you for your kindness.

Currently, I'm still working hard to achieve profitable trades consistently.

Wishing you Profitable in your Trading too.

Yours Sincerely,

Tony Chai

Saturday, November 11, 2006

Winning Trade - EZPW

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment